Bearish Hammer Candlestick Pattern

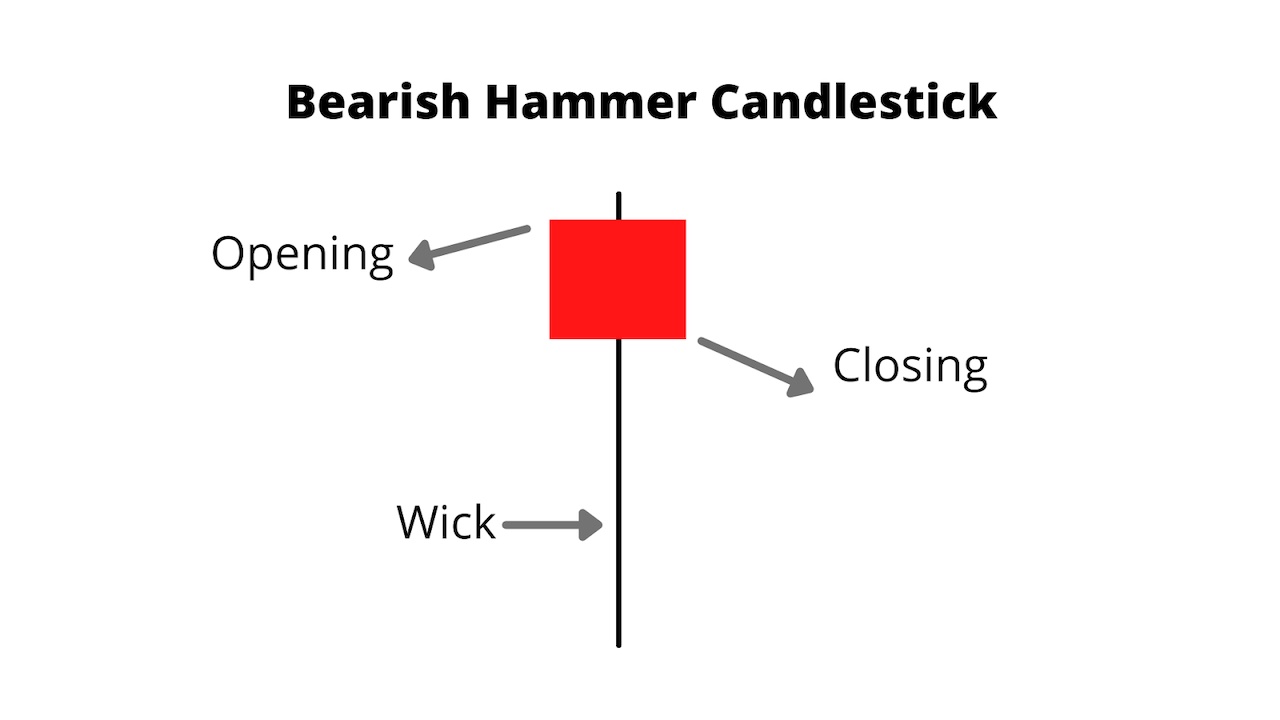

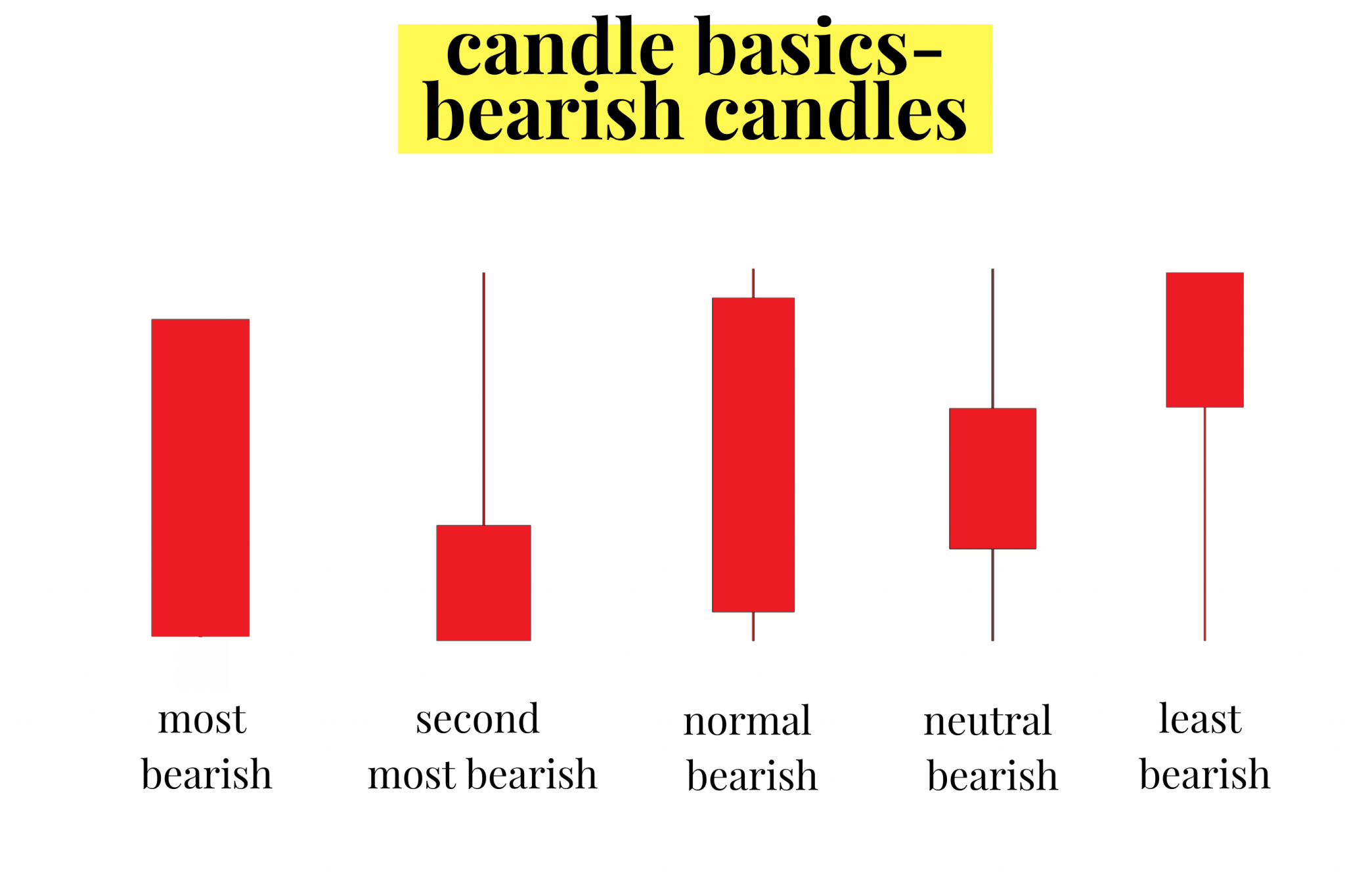

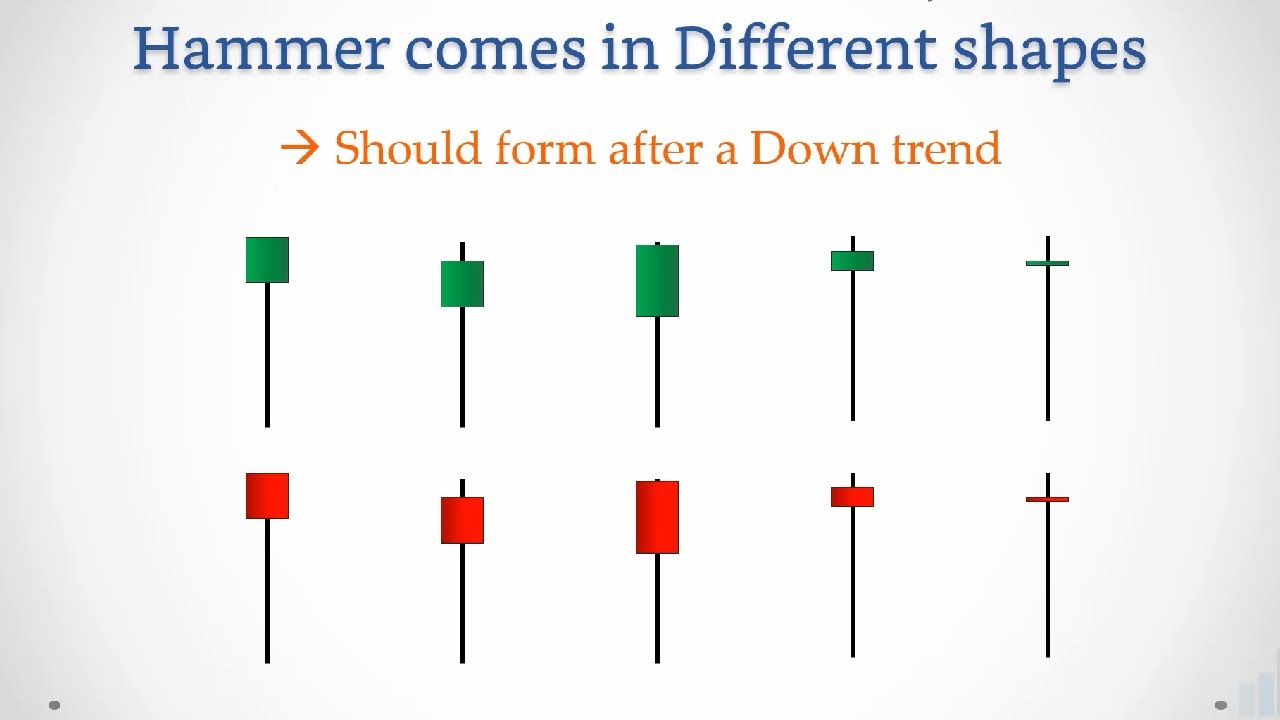

Bearish Hammer Candlestick Pattern - This is known commonly as an inverted hammer candlestick. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Web the bearish hammer, also known as a hanging man, is a single candlestick pattern that forms after an advance in price. This shows a hammering out of a base and reversal setup. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Occurrence after bearish price movement. It has a small candle body and a long lower wick. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. These candles are typically green or white on stock charts. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. This shows a hammering out of a base and reversal setup. This is known commonly as an inverted hammer candlestick. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Advantages and limitations of the hammer chart pattern; Lower shadow more than twice the length of the body. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Typically, it's either red or black on stock charts. These candles are typically green or white on stock charts. Using a hammer candlestick pattern in trading; Web a bearish hammer candlestick looks like a regular hammer, but it goes down instead of the price going up. It has a small real body positioned at the top of the candlestick range and a long lower shadow that is. Web the hammer candlestick is a significant pattern in the realm of. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web the bearish hammer, also known as a hanging man, is a single candlestick pattern that forms after an advance in price. Advantages and limitations of the hammer chart pattern; Lower shadow more than twice the length of the. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. It has a small real body positioned at the top of the candlestick range and a long lower shadow that is. Web the bearish hammer, also known as. Further reading on trading with candlestick. Web what is a hammer candle pattern? The hammer helps traders visualize where support and demand are located. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. This shows a hammering. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. They consist of small to medium size lower shadows, a real body, and little to no upper wick. It has a small candle body and a long lower wick. Advantages and limitations of the hammer chart pattern; When. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. When you see a hammer candlestick, it's often seen as a positive sign for investors. Web this pattern typically appears when a downward trend. It has a small real body positioned at the top of the candlestick range and a long lower shadow that is. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. These. Web a bearish hammer candlestick looks like a regular hammer, but it goes down instead of the price going up. These candles are typically green or white on stock charts. Lower shadow more than twice the length of the body. When you see a hammer candlestick, it's often seen as a positive sign for investors. This is known commonly as. Further reading on trading with candlestick. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. Web hammer candlesticks are a popular reversal. These candles are typically green or white on stock charts. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Advantages and limitations of the hammer chart pattern; Occurrence after bearish price movement. Examples of use as a trading indicator. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. Occurrence after bearish price movement. Examples of use as a trading indicator. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. It has a small real body positioned at the top of the candlestick range and a long lower shadow that is. Advantages and limitations of the hammer chart pattern; This is known commonly as an inverted hammer candlestick. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web the bearish hammer, also known as a hanging man, is a single candlestick pattern that forms after an advance in price. These candles are typically green or white on stock charts. Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. Further reading on trading with candlestick. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Using a hammer candlestick pattern in trading; Lower shadow more than twice the length of the body.Bearish candlestick cheat sheet. Don’t to SAVE Candlesticks

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Bearish Inverted Hammer Candlestick Patterns

Comment Trader avec des modèles Hammer Candlestick (chandeliers en

Candlestick Patterns Explained New Trader U

Hammer Candlestick Example & How To Use 2024

Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

Hammer Doji Candlestick Detector Metatrader Indicator

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Web A Bearish Hammer Candlestick Looks Like A Regular Hammer, But It Goes Down Instead Of The Price Going Up.

This Shows A Hammering Out Of A Base And Reversal Setup.

Web What Is A Hammer Candle Pattern?

When You See A Hammer Candlestick, It's Often Seen As A Positive Sign For Investors.

Related Post: