Falling Wedge Pattern

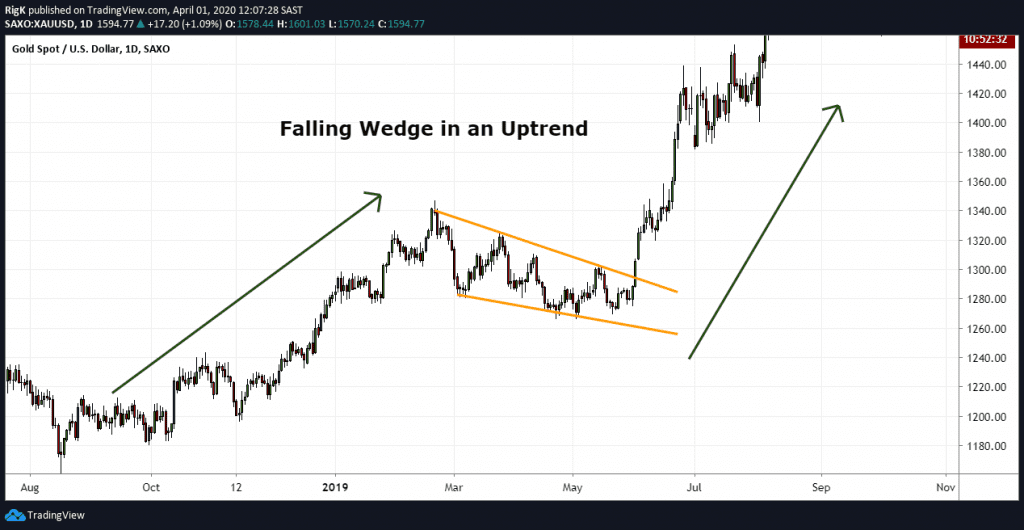

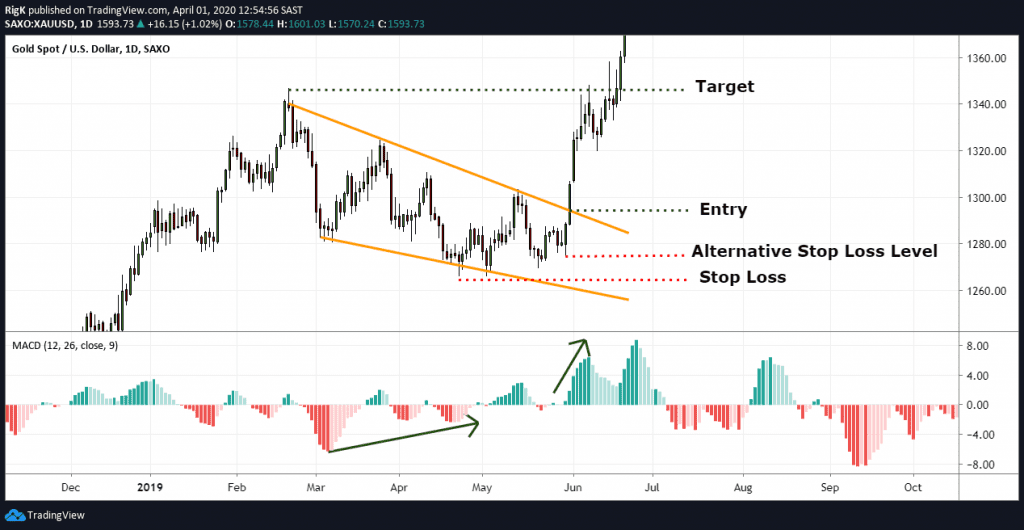

Falling Wedge Pattern - This article provides a technical. Web wedges signal a pause in the current trend. Web a falling wedge is a bullish reversal pattern characterized by converging downward sloping trendlines with decreasing volume, indicating potential upward price. Web a falling wedge can be defined by a set of lower lows (support) and lower highs (resistance) that slope downwards and contract into a narrower range before price. At the time of writing, doge was approaching the resistance of the. Web a falling wedge pattern is seen as a bullish signal as it reflects that a sliding price is starting to lose momentum and that buyers are starting to move in to slow down. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of a downtrend. Web the falling wedge pattern denotes the end of the period of correction or consolidation. Falling wedges are the inverse of rising wedges and are always considered bullish signals. When the pattern occurs, it. It is defined by two trendlines drawn through peaks and bottoms, both headed downward. Wedge trading is one of the most effective. Polkadot (dot) has broken out of a falling wedge pattern, reaching its highest price in the past week. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. That saw qtum (qtum) recording impressive upticks, which saw it overpowering a. Web a falling wedge pattern is considered a bullish signal with a higher probability of an upward breakout, but traders usually watch other technical indicators to confirm the breakout. Web the latest bitcoin (btc) jump past $65k triggered notable upsurges in the altcoin market. The falling wedge price pattern is sometimes. Web the falling wedge pattern happens when the security's price trends in a bearish direction, with two to three lower highs forming. They develop when a narrowing trading range has a. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. Web the falling wedge pattern denotes the end of the period of correction or consolidation. Web the latest bitcoin (btc) jump past $65k triggered notable upsurges in the altcoin market. Web the falling wedge pattern governs the current correction trend in. Web a falling wedge is a bullish reversal pattern characterized by converging downward sloping trendlines with decreasing volume, indicating potential upward price. Web a falling wedge pattern is seen as a bullish signal as it reflects that a sliding price is starting to lose momentum and that buyers are starting to move in to slow down. A falling wedge is. Web a falling wedge is a bullish price pattern that forms during a positive trend, signaling a short pause before a potential breakout to the upside. Web a falling wedge pattern is considered a bullish signal with a higher probability of an upward breakout, but traders usually watch other technical indicators to confirm the breakout. Polkadot (dot) has broken out. As a descending wedge pattern, it develops on the chart when there are lower bottoms and. Web the falling wedge pattern happens when the security's price trends in a bearish direction, with two to three lower highs forming. Falling wedges are the inverse of rising wedges and are always considered bullish signals. Web wedges signal a pause in the current. Wedge trading is one of the most effective. It is considered a bullish. That saw qtum (qtum) recording impressive upticks, which saw it overpowering a. This article provides a technical. Web the falling wedge is a bullish pattern that suggests potential upward price movement. Web a falling wedge is a bullish price pattern that forms during a positive trend, signaling a short pause before a potential breakout to the upside. As a descending wedge pattern, it develops on the chart when there are lower bottoms and. Web the falling wedge pattern denotes the end of the period of correction or consolidation. Web the falling. Web wedges signal a pause in the current trend. Web a falling wedge pattern is an exact mirror image of the rising wedge. Web a falling wedge is a bullish price pattern that forms during a positive trend, signaling a short pause before a potential breakout to the upside. They develop when a narrowing trading range has a. A falling. Web the falling wedge chart pattern is a strong pattern and can be used for forex trading, crypto trading, and stocks trading. Web a falling wedge pattern forms during a downtrend when price consolidates between two downward converging support and resistance lines. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging. Web wedges signal a pause in the current trend. Web the falling wedge pattern is the opposite of the rising wedge: Web the latest bitcoin (btc) jump past $65k triggered notable upsurges in the altcoin market. As a descending wedge pattern, it develops on the chart when there are lower bottoms and. Web the falling wedge is a bullish chart. They develop when a narrowing trading range has a. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. Web the falling wedge pattern governs the current correction trend in the link price. As a descending wedge pattern, it develops on the chart when there are lower bottoms and. This. Web the falling wedge pattern is the opposite of the rising wedge: Polkadot (dot) has broken out of a falling wedge pattern, reaching its highest price in the past week. Web in technical analysis, the falling wedge pattern stands out for its unique shape and implications on market trends. Web a falling wedge pattern forms during a downtrend when price consolidates between two downward converging support and resistance lines. It is considered a bullish. Web a falling wedge pattern is a continuation pattern when it forms after a price consolidation in a bullish uptrend and a falling wedge is a reversal pattern when it forms. A falling wedge is a. Web a falling wedge pattern is considered a bullish signal with a higher probability of an upward breakout, but traders usually watch other technical indicators to confirm the breakout. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. Web the falling wedge pattern happens when the security's price trends in a bearish direction, with two to three lower highs forming. That saw qtum (qtum) recording impressive upticks, which saw it overpowering a. Web the falling wedge pattern trading strategy is a reversal trading strategy that has the potential to generate big profits. Web a falling wedge is a bullish reversal pattern characterized by converging downward sloping trendlines with decreasing volume, indicating potential upward price. As a descending wedge pattern, it develops on the chart when there are lower bottoms and. This pattern, while sloping downward, signals a likely trend reversal or continuation,. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower.Trading the Falling Wedge Pattern

The Falling Wedge Pattern Explained With Examples

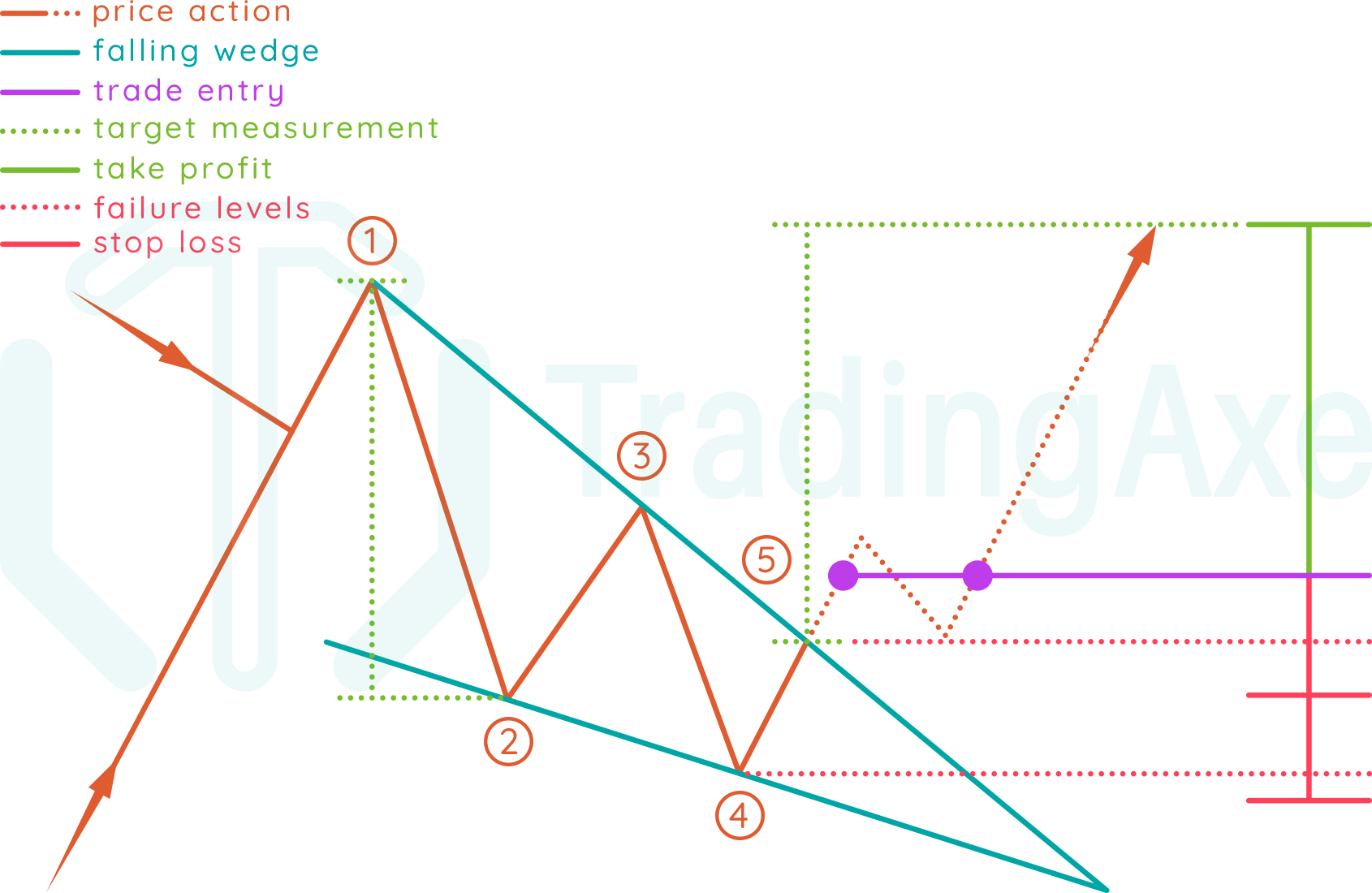

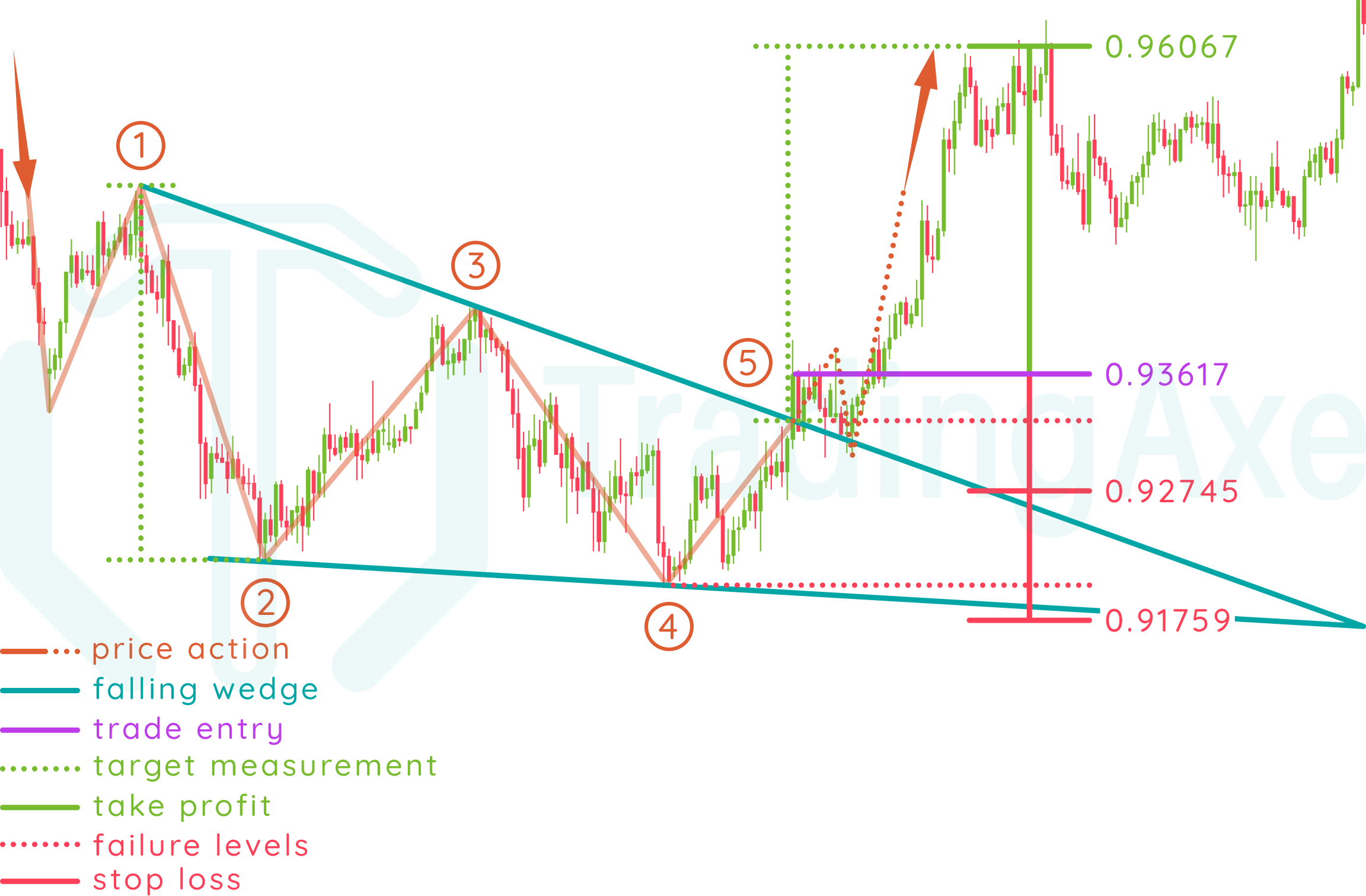

How To Trade Falling Wedge Chart Pattern TradingAxe

How To Trade Blog What Is A Wedge Pattern? How To Use The Wedge

Forex chart pattern trading on Wedge Pattern

How To Trade Falling Wedge Chart Pattern TradingAxe

Simple Wedge Trading Strategy For Big Profits

Wedge Patterns How Stock Traders Can Find and Trade These Setups

The Falling Wedge Pattern

The Falling Wedge Pattern Explained With Examples

Web Wedges Signal A Pause In The Current Trend.

This Article Provides A Technical.

Web The Falling Wedge Pattern Is A Continuation Pattern Formed When Price Bounces Between Two Downward Sloping, Converging Trendlines.

It Reverses To Bullish Once.

Related Post: