Head And Shoulders Pattern Inverse

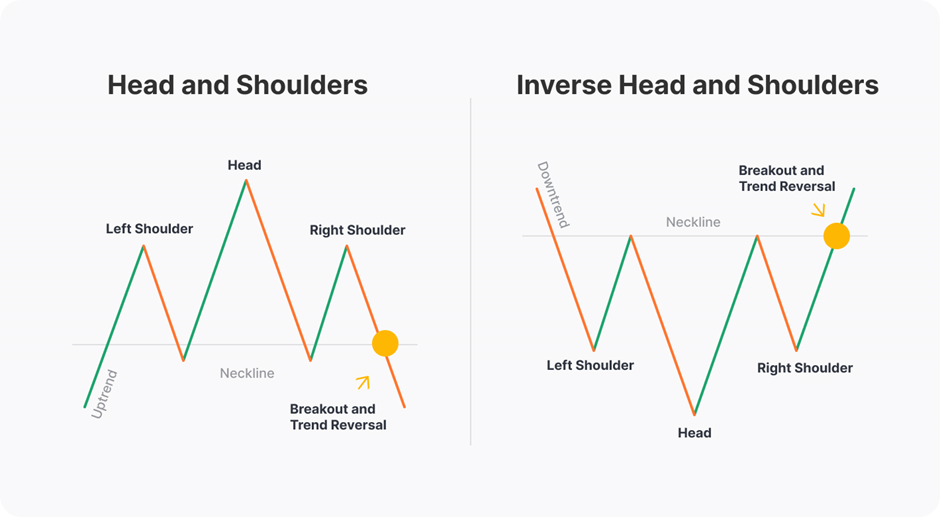

Head And Shoulders Pattern Inverse - This article addresses these by showing you the common hallmarks of a failed (inverse) head and shoulders pattern and how to mitigate losses when this. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. Web [2] head and shoulders bottom. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. The weekly chart provides more hints about what to expect this week. However, not much is written about its shortcomings. It is the opposite of the head and shoulders chart pattern, which is a. By closing at 1.0882 on friday, the pair formed a shooting star chart pattern, a popular reversal sign, meaning that the pair could see more downside, at least in the. Web the inverse head and shoulders pattern is a reversal pattern in stock trading. It represents a bullish signal suggesting a potential reversal of a current downtrend. Web inverse head and shoulders pattern is the mirror image of head and shoulders pattern. Web the inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). Web a head and shoulders pattern is a chart formation used by technical analysts. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Web [2] head and shoulders bottom. The outside two are close in height and the middle is the. By closing at 1.0882 on friday, the pair formed a shooting star chart pattern, a popular reversal sign, meaning that the pair could see more downside, at least in the. Web the inverse head and shoulders pattern is a reversal pattern in stock trading. Web most notably, it has also formed an inverse head and shoulders chart pattern, which is often a bullish sign. It is the opposite of the head and shoulders chart pattern, which is a. The height of the pattern plus the breakout price should be your target price using this indicator. Stronger preceding trends are prone to more dramatic reversals. The inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to. Web the inverse head and shoulders pattern is a reversal pattern in stock trading. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. Traders and investors can use the pattern because it. The pattern appears as a baseline with three peaks: The right shoulder on these patterns typically is higher than the left, but many times it’s equal. It is the opposite of the head and shoulders chart pattern, which is a. However, not much is written about its shortcomings. Following this, the price generally goes to the upside and starts a. The inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. This reversal could signal an. Web the inverse head and shoulders pattern is one of the most accurate technical analysis reversal patterns, with a reliability of 89%. Web the inverse head and shoulders pattern is a chart. Web what is an inverse head and shoulders pattern? Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. [3] the formation is upside down and the volume pattern is different from a head and shoulder top. Web when a head and shoulders formation is seen in a downtrend,. Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. By closing at 1.0882 on friday, the pair formed a shooting star chart pattern, a popular reversal sign, meaning that the pair could see more downside, at least in the. This pattern is a trend reversal chart. This reversal could signal an. Web inverse head and shoulders pattern is the mirror image of head and shoulders pattern. It is the opposite of the head and shoulders chart pattern, which is a. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. This article addresses these by showing you the common. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. [3] the formation is upside down and the volume pattern is different from a head and shoulder top. This formation is simply the inverse of a head and shoulders top and often indicates a change in the trend and market sentiment. Web inverse. Web [2] head and shoulders bottom. Inverse h&s pattern is bullish reversal pattern. Traders and investors can use the pattern because it occurs. It occurs when the price hits new lows on three separate occasions, with two lows forming the shoulders and the central trough forming the head. The pattern resembles the shape of a person’s head and two shoulders. Web the inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). This reversal could signal an. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Volume play a major role in both h&s. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. Web the inverse head and shoulders pattern is one of the most accurate technical analysis reversal patterns, with a reliability of 89%. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. It is of two types: The pattern appears as a head, 2 shoulders, and neckline in an inverted position. The head and shoulders top used to predict downtrend reversals. This formation is simply the inverse of a head and shoulders top and often indicates a change in the trend and market sentiment. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. The first and third lows are called shoulders. Web what is an inverse head and shoulders pattern? The pattern appears as a baseline with three peaks: Web a head and shoulders pattern is a chart formation used by technical analysts. Head & shoulder and inverse head & shoulder. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. The outside two are close in height and the middle is the. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis.How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Inverse Head and Shoulders Chart Pattern in 2020 Trading charts

How to Trade with the Inverse Head and Shoulders Pattern Market Pulse

Inverse Head And Shoulders Pattern [2023 Update] Daily Price Action

Head And Shoulders Chart Meaning

Head and Shoulders Pattern What Is It & How to Trade With It? Bybit

Inverse Head and Shoulders Pattern How To Spot It

Head and Shoulders Trading Patterns ThinkMarkets EN

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Inverse Head and Shoulders Pattern Trading Strategy Guide

The Weekly Chart Provides More Hints About What To Expect This Week.

By Closing At 1.0882 On Friday, The Pair Formed A Shooting Star Chart Pattern, A Popular Reversal Sign, Meaning That The Pair Could See More Downside, At Least In The.

The Pattern Resembles The Shape Of A Person’s Head And Two Shoulders In An Inverted Position, With Three Consistent Lows And Peaks.

However, Not Much Is Written About Its Shortcomings.

Related Post:

![Inverse Head And Shoulders Pattern [2023 Update] Daily Price Action](https://dailypriceaction.com/wp-content/uploads/2015/03/Inverse-head-and-shoulders-confirmed.jpg)