Island Reversal Pattern

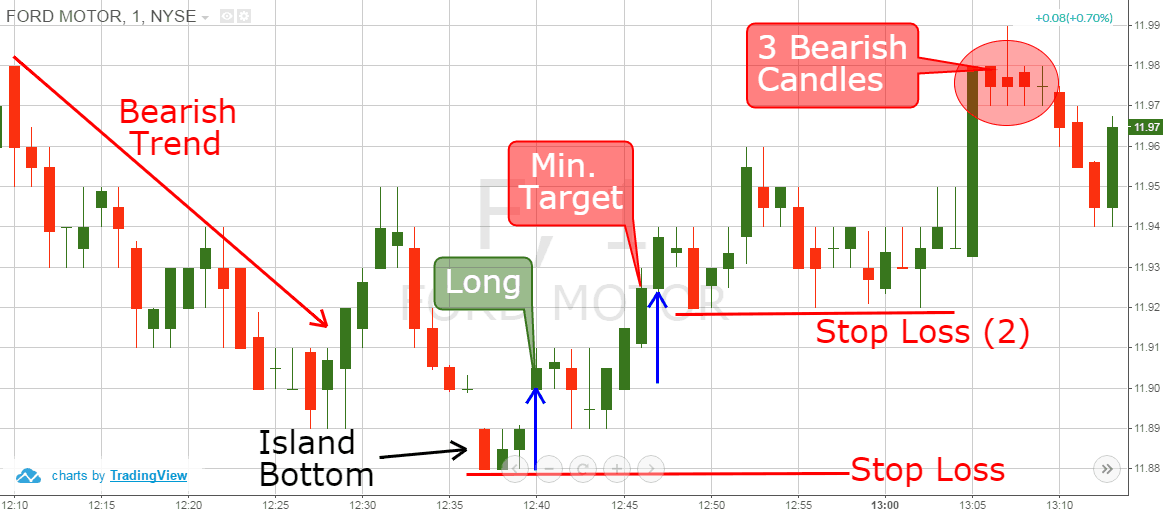

Island Reversal Pattern - It occurs on bar or candlestick charts and is characterized by a short series of trading activities isolated from the rest of the price action by gaps on both sides. The island reversal pattern is a rare trend shift indicator featuring a period of trading activity that is distinct and separated from the preceding and succeeding trends. The island reversal is formed when there is a gap up or down in price followed by a few days of trading in a tight price range, creating the visual effect of an “island” separated from the mainland of price action. Second gap occurs only this time the. Subsequently, it is succeeded by a downward one. Web island reversal is a distinct price pattern in technical analysis characterized by gaps in price action. Web what is the island reversal pattern? An initial downward gap followed by an upward gap signifies a bullish island reversal. An island reversal gets it name from the fact that the candlestick appears to be all alone, as if on an island. After trading in the new. Web the island reversal pattern is a chart formation that stands out for its distinctive appearance and implications for trend reversal. Web island reversal is a distinct price pattern in technical analysis characterized by gaps in price action. It appears after significant price movements and is characterized by isolated price bars, typically confirmed by high trading volume. It is identified by a gap both before and after a price consolidation, creating an ‘island’ of prices disconnected from the rest of the chart. Subsequently, it is succeeded by a downward one. Higher range for several sessions, a. Web the island reversal is a key pattern in technical analysis that indicates potential market trend reversals. Web an island reversal is a chart formation where there is a gap on both sides of the candle. An island reversal is a price pattern that, on a daily chart, shows a grouping of days separated on either side by gaps in the price action. Second gap occurs only this time the. Web an island reversal is a reversal pattern that forms with two gaps and price action in between the two gaps. A candlestick pattern is a movement in prices shown graphically on a candlestick chart. As in the name, it is a trend reversal pattern that suggests a bullish or bearish trend may be reaching an exhaustion point. The island. They are identified by a gap between a reversal candlestick and two candles on either side of it. It is identified by a gap both before and after a price consolidation, creating an ‘island’ of prices disconnected from the rest of the chart. Web island reversals materialize when prices find themselves marooned amidst gaps, isolated from preceding trends. It occurs. A bullish island reversal forms with a gap down, short consolidation and gap up. Web the island reversal pattern is a candlestick pattern in stock trading that helps traders to predict future price direction. Web the island reversal pattern is a chart pattern that involves a gap in price, consolidation and then another gap in the opposite direction. Web what. Web island reversal pattern. In a bullish rally, prices surge above the prior session's close, forming an upside gap. These gaps tell us that the island reversal marks a sudden, and sharp, shift in direction. It appears after significant price movements and is characterized by isolated price bars, typically confirmed by high trading volume. Web an island reversal is a. Web what is the island reversal pattern? A candlestick pattern is a movement in prices shown graphically on a candlestick chart. Conversely, a bearish island reversal manifests as—firstly—an upward gap; Web an island reversal pattern is a technical analysis formation that signifies a potential reversal in the direction of a trend. These gaps tell us that the island reversal marks. The island pattern is often used as an identifier of a trend reversal. Web an island reversal is a reversal pattern that forms with two gaps and price action in between the two gaps. Web the island reversal pattern is a chart pattern that involves a gap in price, consolidation and then another gap in the opposite direction. After trading. The island pattern is often used as an identifier of a trend reversal. It is identified by a gap both before and after a price consolidation, creating an ‘island’ of prices disconnected from the rest of the chart. It appears after significant price movements and is characterized by isolated price bars, typically confirmed by high trading volume. As in the. Web in the context of trading, the island reversal pattern is a powerful and rare chart formation, signaling a potential reversal in price direction. Conversely, a bearish island reversal manifests as—firstly—an upward gap; A bearish island reversal forms with a gap up, short consolidation and gap down. Web the island reversal is a key pattern in technical analysis that indicates. Island reversals frequently show up after a trending move is in its final stages. A bearish island reversal forms with a gap up, short consolidation and gap down. Web what is the island reversal pattern? A bullish island reversal forms with a gap down, short consolidation and gap up. These gaps tell us that the island reversal marks a sudden,. Traders with positions taken between the two gaps are stuck with losing positions. It is identified by a gap both before and after a price consolidation, creating an ‘island’ of prices disconnected from the rest of the chart. After trading in the new. Web what is an island reversal? Subsequently, it is succeeded by a downward one. Web the island reversal is a candlestick pattern that signals a potential trend reversal. Web the island reversal pattern is a candlestick pattern in stock trading that helps traders to predict future price direction. An island reversal is a price pattern that, on a daily chart, shows a grouping of days separated on either side by gaps in the price action. Two gaps in the same direction and an intervening consolidation period, effectively isolating a ‘block’ or ‘island’ of price action. Higher range for several sessions, a. These gaps tell us that the island reversal marks a sudden, and sharp, shift in direction. The pattern consists of three critical periods: Web in the context of trading, the island reversal pattern is a powerful and rare chart formation, signaling a potential reversal in price direction. They are identified by a gap between a reversal candlestick and two candles on either side of it. Web what is an island reversal? Subsequently, it is succeeded by a downward one. After a few sessions, a downside gap emerges, bringing prices below the prior close. An island reversal gets it name from the fact that the candlestick appears to be all alone, as if on an island. How to trade the island reversal candlesticks pattern. Island reversals are isolated data. It is identified by a gap both before and after a price consolidation, creating an ‘island’ of prices disconnected from the rest of the chart.How to Trade the Island Reversal Pattern (in 3 Easy Steps)

Island Reversal Definition

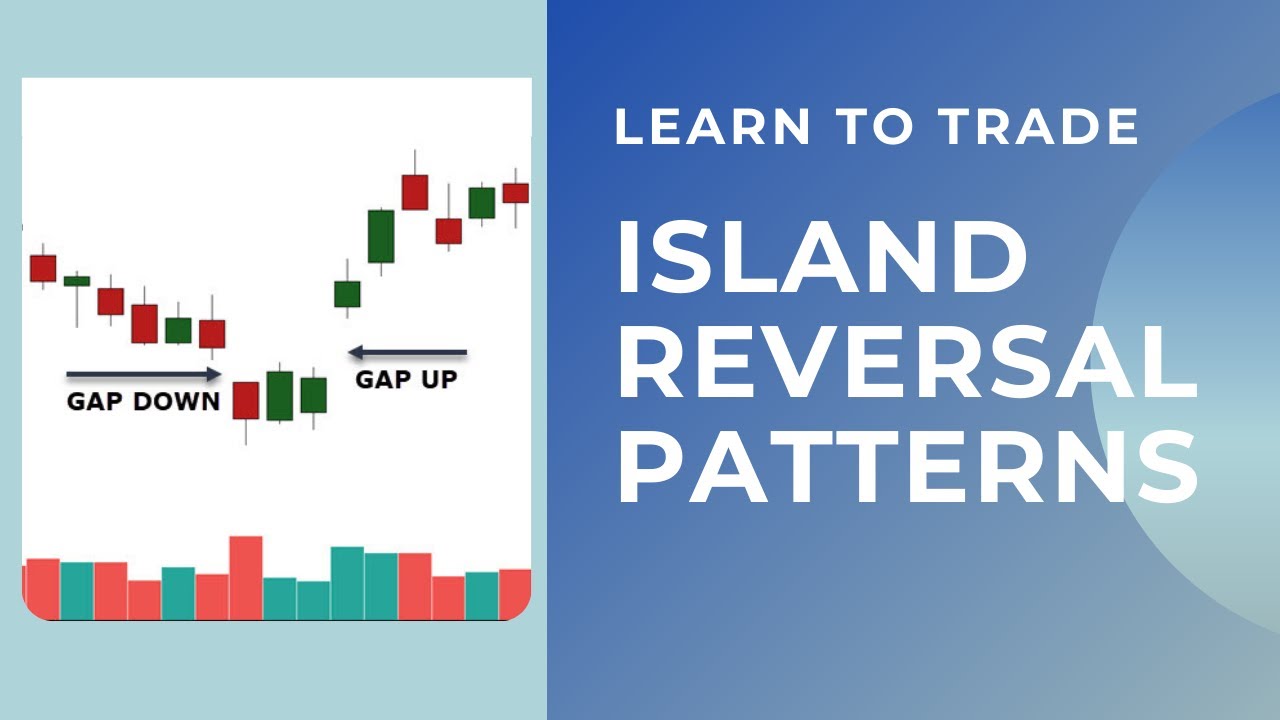

Learn To Trade The Island Reversal Pattern For EXPLOSIVE GAINS. YouTube

How to Trade the Island Reversal Pattern (in 3 Easy Steps)

Island Reversal Pattern Guide How to Trade the Bullish Island

Island Reversal Pattern Guide How to Trade the Bullish Island

Island Reversal Candlestick Pattern with FREE PDF Download Trading PDF

Island Reversal 3 Simple Trading Strategies TradingSim

Island Reversal Definition

How to Trade the Island Reversal Pattern (in 3 Easy Steps)

Web In Both Stock Trading And Financial Technical Analysis, An Island Reversal Is A Candlestick Pattern With Compact Trading Activity Within A Range Of Prices, Separated From The Move Preceding It.

Web The Island Reversal Pattern Is A Chart Pattern That Involves A Gap In Price, Consolidation And Then Another Gap In The Opposite Direction.

An Initial Downward Gap Followed By An Upward Gap Signifies A Bullish Island Reversal.

Traders With Positions Taken Between The Two Gaps Are Stuck With Losing Positions.

Related Post:

:max_bytes(150000):strip_icc()/dotdash_Final_Island_Reversal_Aug_2020-01-b8219aac72e14acc90012160dd17f4d6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Island_Reversal_Aug_2020-02-018c391240e54aa58a31a246122f20cd.jpg)