Stock Patterns Triangle

Stock Patterns Triangle - Other successful patterns include the double bottom (88 percent) and the ascending triangle (83 percent). Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. They are considered bullish chart patterns that reveal to a trader that a breakout is likely to occur at the point where the triangle lines converge. There are three potential triangle variations that can develop. Web an ascending triangle pattern is established when a stock is generally climbing but encounters resistance and drops back before continuing upward. Web here are 7 of the top chart patterns used by technical analysts to buy stocks. The price movements form a series of. Web learn how to identify and trade the ascending triangle chart pattern, a bullish continuation pattern formed by a horizontal resistance level and a rising support level. Web the head and shoulder bottom pattern is proven to be the most successful chart pattern in a bull market, with an 88 percent accuracy rate and an average price change of +50 percent. Dec 24, 2023, 5:36 am pst. While triangles are a common chart pattern, i require very specific criteria to materialize in order for me to take a trade. Each has a proven success rate of over 85%, with an average gain of 43%. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Web an ascending triangle pattern is established when a stock is generally climbing but encounters resistance and drops back before continuing upward. The stock price moves in a sideways direction within a price channel, getting narrower until. The price movements form a series of. They are named triangles as the upper and lower trend line eventually meet to form a tip and connecting the starting points of both trend lines completes a triangle shape. Web 📊 discovering all triangle chart patterns 📈 welcome, traders and investors, to the exciting world of triangle patterns! Web a triangle pattern is an example of a continuation pattern demonstrating this type of price action; Web ascending triangle trading chart patterns are some of the most widely used stock market patterns. Each has a proven success rate of over 85%, with an average gain of 43%. The target price level depends on the direction in which the price broke this pattern. Web traders use triangles to highlight when the narrowing of a stock or security's trading range after a downtrend or uptrend occurs. Traders watch the price of x financial, a. Triangles are classified as continuation patterns by technical analysts. The stock price moves in a sideways direction within a price channel, getting narrower until. Web here are two day trading strategies for three types of triangle chart patterns, including how to enter and exit trades and how to manage risk. Web a triangle pattern is an example of a continuation. Web ascending triangle trading chart patterns are some of the most widely used stock market patterns. Web there are three potential triangle variations that can develop as price action carves out a holding pattern, namely ascending, descending, and symmetrical triangles. The highs around the resistance price form a horizontal line, while the consecutively higher lows form an ascending line. Web. It is expected that after the pattern breakout, the price will go approximately to the height of the triangle base in the direction of the breakout. Each has a proven success rate of over 85%, with an average gain of 43%. Web triangle patterns are one of my favorite stock swing trading strategies. Web a pattern is identified by a. Web 📊 discovering all triangle chart patterns 📈 welcome, traders and investors, to the exciting world of triangle patterns! Web traders use triangles to highlight when the narrowing of a stock or security's trading range after a downtrend or uptrend occurs. Symmetrical, ascending, descending and broadening triangles. The stock price moves in a sideways direction within a price channel, getting. While triangles are a common chart pattern, i require very specific criteria to materialize in order for me to take a trade. It is expected that after the pattern breakout, the price will go approximately to the height of the triangle base in the direction of the breakout. There are three potential triangle variations that can develop. Web triangle patterns. I also call triangles “contraction patterns”. Web an ascending triangle pattern is established when a stock is generally climbing but encounters resistance and drops back before continuing upward. Web an ascending triangle is a chart pattern formed when a stock repeatedly tests an area of resistance while setting consecutively higher lows. Web triangles are known as continuation patterns, meaning the. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Web a triangle pattern forms when a stock’s trading range narrows following an uptrend or downtrend, usually indicating a consolidation, accumulation, or distribution before a continuation or reversal. Web a triangle is an indefinite pattern. Web triangle patterns are one of my favorite stock swing trading strategies. Traders watch the price of x financial, a chinese technology. The target price level depends on the direction in which the price broke this pattern. Web a triangle chart pattern forms when the trading range of a financial instrument, for example, a stock, narrows following a downtrend or. Web traders use triangles to highlight when the narrowing of a stock or security's trading range after a downtrend or uptrend occurs. Today, we'll explore all known triangle shapes: While triangles are a common chart pattern, i require very specific criteria to materialize in order for me to take a trade. Web published research shows the most reliable and profitable. Web triangles are known as continuation patterns, meaning the trend stalls out to gather steam before the next breakout or breakdown. Other successful patterns include the double bottom (88 percent) and the ascending triangle (83 percent). The price movements form a series of. Good volume buildup can also be visible for several weeks. Entry can be made upon breaking the previous day's high levels of 1739. Each has a proven success rate of over 85%, with an average gain of 43%. Web the head and shoulder bottom pattern is proven to be the most successful chart pattern in a bull market, with an 88 percent accuracy rate and an average price change of +50 percent. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. Today, we'll explore all known triangle shapes: Triangles are classified as continuation patterns by technical analysts. Web triangle patterns are one of my favorite stock swing trading strategies. The highs around the resistance price form a horizontal line, while the consecutively higher lows form an ascending line. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Such a chart pattern can indicate a trend reversal or the continuation of a trend. Web 📊 discovering all triangle chart patterns 📈 welcome, traders and investors, to the exciting world of triangle patterns! Symmetrical, ascending, descending and broadening triangles.Triangles A Short Study in Continuation Patterns

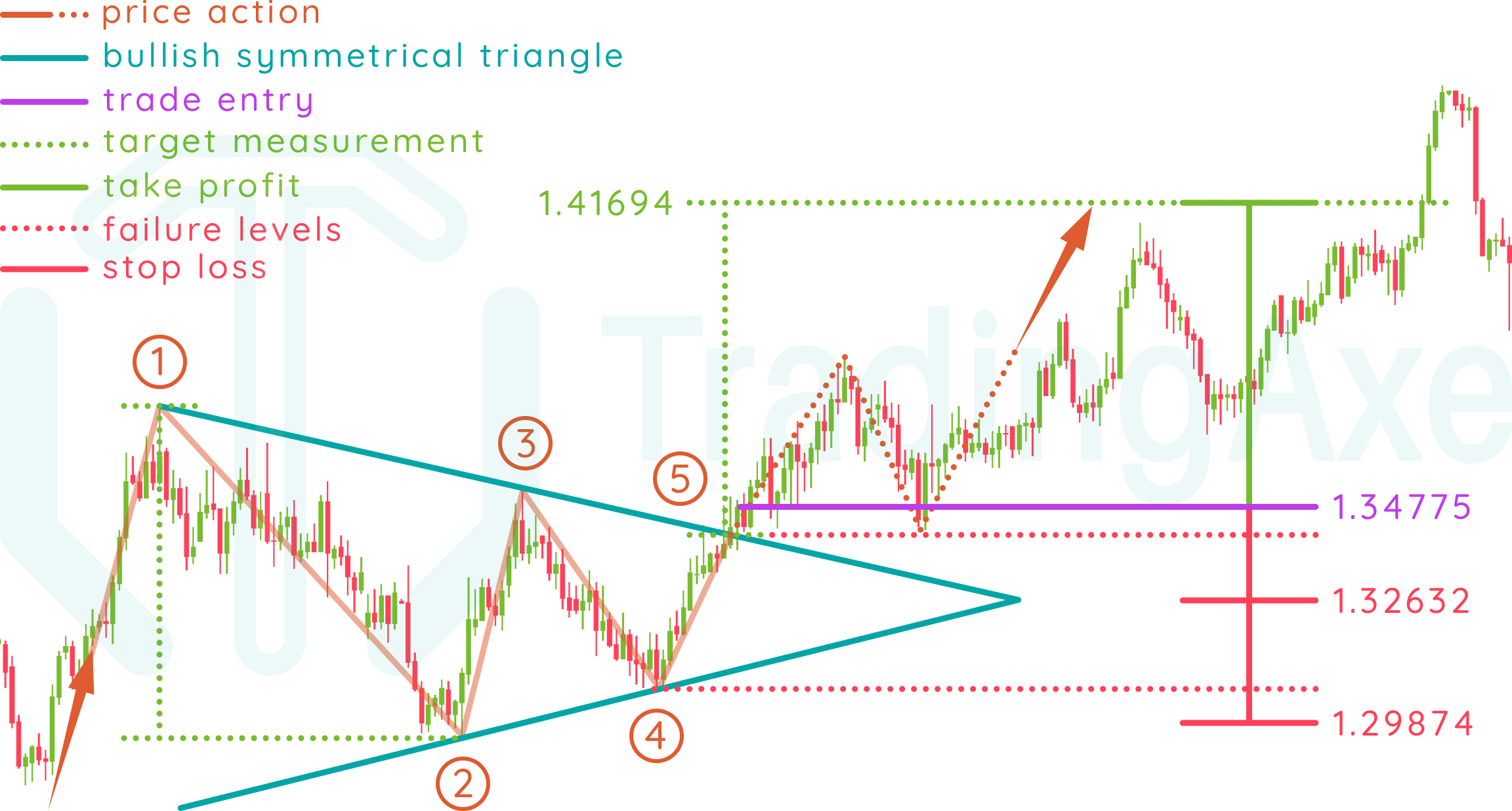

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

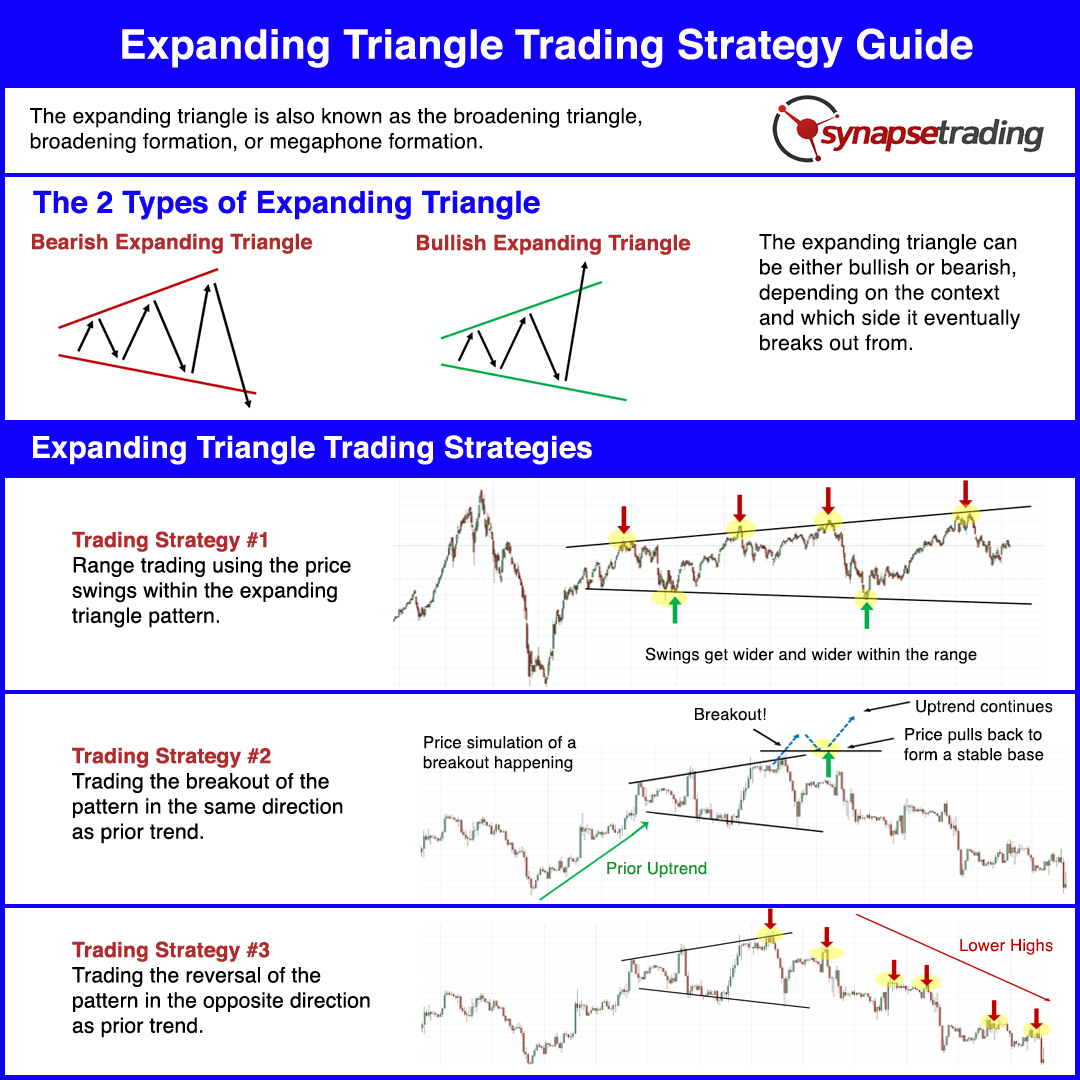

triangle chart pattern Archives Synapse Trading

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Triangle Chart Patterns Complete Guide for Day Traders

The Definitive Guide to Trading Price Chart Patterns (Updated 2020)

Triangle Chart Patterns A Guide to Options Trading

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

How to Trade Triangle Chart Patterns FX Access

3 Triangle Patterns Every Forex Trader Should Know LiteFinance

Web Here Are Two Day Trading Strategies For Three Types Of Triangle Chart Patterns, Including How To Enter And Exit Trades And How To Manage Risk.

Web A Triangle Chart Pattern Forms When The Trading Range Of A Financial Instrument, For Example, A Stock, Narrows Following A Downtrend Or An Uptrend.

It Is Expected That After The Pattern Breakout, The Price Will Go Approximately To The Height Of The Triangle Base In The Direction Of The Breakout.

While Triangles Are A Common Chart Pattern, I Require Very Specific Criteria To Materialize In Order For Me To Take A Trade.

Related Post:

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns2_2-bdc113cc9d874d31bac6a730cd897bf8.png)